Introducing NielsenIQ Activate

The presentation came one day following the formal release of NielsenIQ Activate and featured Jamie Clarke, head of North American Retail, Xavier Facon, Global Head of Retail Media, and Beni Basel, founder and CEO of ciValue, acquired earlier this year by NielsenIQ.

NielsenIQ Activate is a software-as-a-service (SaaS) solution that enables retailers to accelerate revenue opportunities through comprehensive customer insights, then activate shoppers with personalized promotional offers and retail media advertising.

Deployed as a collaboration platform, it enables consumer goods companies (CPGs) to define and assemble audiences, obtain insights driven by both retailer and NIQ data sources, plan and deploy campaigns, and measure results. The embedded technology from ciValue is a central element of the NielsenIQ Activate platform, providing self-service interactivity and collaboration for retailers and CPGs.

The executive’s guide to retail media

Download our guide to read a practical perspective for managers who occupy both sides of the retail media buying table.

Retail media, personalized offers, and other touchpoints

The release of NielsenIQ Activate comes at a time when the global retail industry is moving rapidly to establish new revenue opportunities from retail media networks. Brand marketers are actively investing in digital advertising alongside traditional forms of consumer promotion in an increasingly complex media environment.

“Driving consumer engagement is harder than ever,” said Jamie Clarke, Head of North American Retail. “Our perspective on the future is that advertising across channels will be powered by consumer data and analytics.”

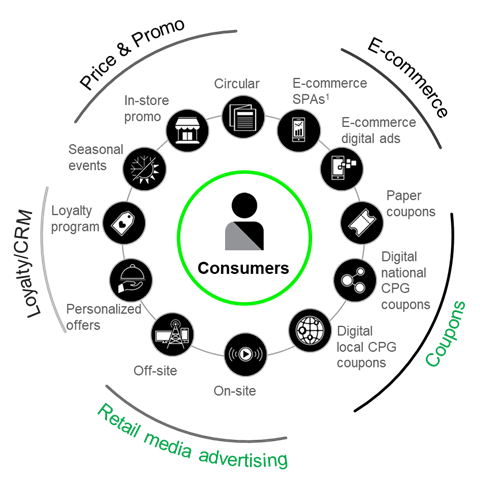

He described the vast number of touchpoints with potential to influence customers today from the retailer and their CPG partners:

- E-commerce sponsored product ads and display ads when they shop

- Coupons in several forms—paper coupons in the Sunday paper, tear-off coupons on a display in the store and digital coupons—whether in a retailer’s gallery or through email

- On-site retail media advertising, which is a key factor in recent growth

- Loyalty offers in the form of points or personalized offers

- Newer forms of off-site retail media

- “Old-school” tactics including circulars and others

“There is a very fragmented ecosystem of providers around all of this,” Clarke said, explaining how the complexity creates massive challenges for retailers and brands as they try to plan and execute campaigns.

“NielsenIQ Activate closes the loop on all of it. It now enables us to go beyond analytics and insights to then enable activation.”

Elements of the Activate platform

In launching NielsenIQ Activate, the company draws upon a century of leadership providing high-quality retail and shopper data insights. Retailers and brands worldwide rely upon these resources to make and evaluate category plans and promotions and understand their shoppers.

“Driving consumer engagements is harder than ever,” Clarke said. “Our perspective on the future is that advertising across channels will be powered by consumer data and analytics.”

In the digital era, there is a much greater emphasis on speed to decision and managing complexity. Adding AI-enabled technology from our acquisition of ciValue is intended to provide users with quick access in an intuitive format that can slash planning cycles and bring campaigns to market more rapidly.

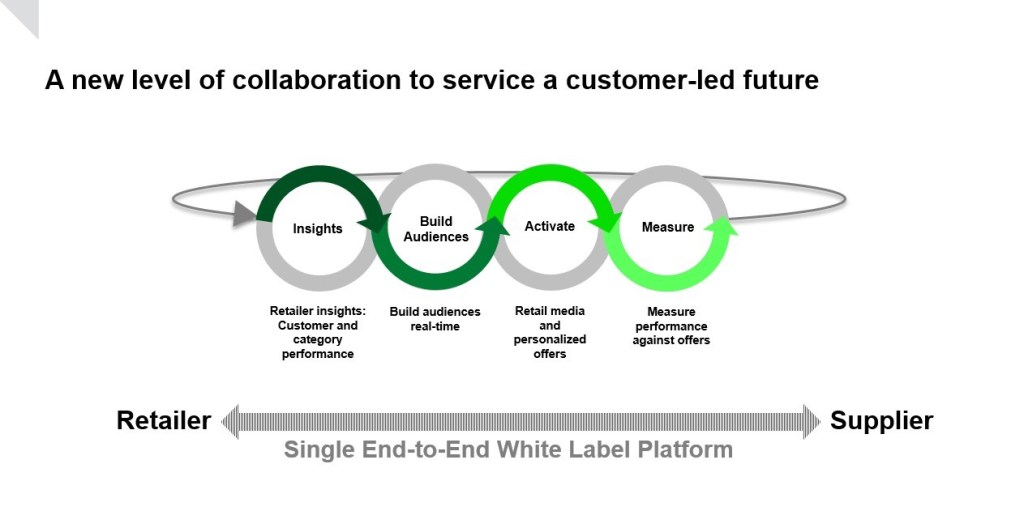

NielsenIQ Activate comprises four core connected elements and is configured for use as a day-to-day performance measurement hub and tool set. The four elements include:

- Retailer insights with customer and category performance

- Real-time audience-building

- Retail media and personalized offers

- Performance measurement

“If I were still a merchant, I’d use this every day of the week for my category performance insights. In addition, it’s got best-in-class customer insights that overlay on top of that.”

Jamie Clarke, Head of North American Retail, NielsenIQ.

Benefits for retailers

By design, the Activate platform enables deeper collaboration with suppliers to drive performance. As Clarke explained, it can help change the perception of retail media networks from a “tax” on CPGs to a “value add” that helps them achieve their own brand objectives.

“For retailers, let’s face it, there’s a monetization aspect to collaboration capabilities,” he said.

The challenge is to “do that monetization in a modern way that enables a self-serve platform to give more control to your CPG partners to do more with the data,” Clarke said. The objective is to drive measurable business performance for both partners.

Allowing permission-based access in the context of a collaboration platform enables the delivery of personalized experiences while protecting your customer data.

“Finally it enables a retailer to really deploy their marketing team in a far more agile way to work in that customer engagement, to make that optimal, and drive transactions at the store,” Clarke explained.

Benefits for CPGs

For the brand marketers, it’s really about gaining better control of their marketing campaigns, Clarke said.

“CPGs have great skills and a lot of them, over on their side of the fence,” he said. “Those people are not getting the tools to enable their skills to be put to great use in today’s environment. We’re hoping this will solve that problem.”

A shared platform environment will enable CPGs to work more closely with merchants in a day-to-day setting, fostering fact-based discussions about retail media and personalized offers.

“This is also about removing the middleman,” Clarke said. “We talked earlier about all the fragments and providers fitting into this customer ecosystem. This enables a more direct connection between the retailer and the CPG, to interact and cut out a lot of time and effort and some costs.”

The Activate platform moves the entire negotiation from a PowerPoint-type relationship to one that is action-oriented. Clarke described a common scenario where a CPG gathers data from a customer portal, builds a PowerPoint, and asks the merchant for a meeting to present a new insight.

“Two weeks later you get a meeting, and then another six to ten weeks before it hits the street on the shelf. You’ve missed the whole quarter every time that happens,” he said. “This enables a far quicker enablement of action.”

Another important advantage for CPGs is the closed-loop ability to measure the ROAS of retail media, and ROI from personalized offers. This enables confirmation that the campaigns are executed as planned and how they can be improved, Clarke said.

“Rigor and integrity”

Commenting on the potential of NielsenIQ Activate to help move the industry forward, Xavier Facon, Global Head of retail media said, “We can see that the evolution of retail media really has evolved to where companies like NielsenIQ are adding a level of rigor and integrity to this space.”

With the launch of NielsenIQ Activate, retailers and CPGs gain a platform where new revenues and new customers can be added in an atmosphere of transparency and trust.