Considerations for business future-proofing

To future-proof your business, consider the following:

- Deliver value, which isn’t always about price, but problem-solving through bundling options, channel-specific sizes, and trial-driving strategies.

- Investing now to protect the future of your brand. Consumers understand the price value equation and will reward brands that give good value and performance with a low cost of ownership.

- Use AI to continuously monitor, adjust, and course correct. Artificial Intelligence (AI) provides constant surveillance and predictive capabilities. You can pivot your business quickly, but more importantly, be proactive in your responses to changing market conditions.

Let the past guide the future

CPG professionals don’t have to reach too far back in our history to remember “the needle in the arm” promotions. We wondered what else we could do to drive greater return on investment (ROI) or lift, only to be brought back to the reality of trying to protect share year-over-year. Trade plans were loaded down with retailer-specific programs where a return was difficult to measure, and profit centers were prolific.

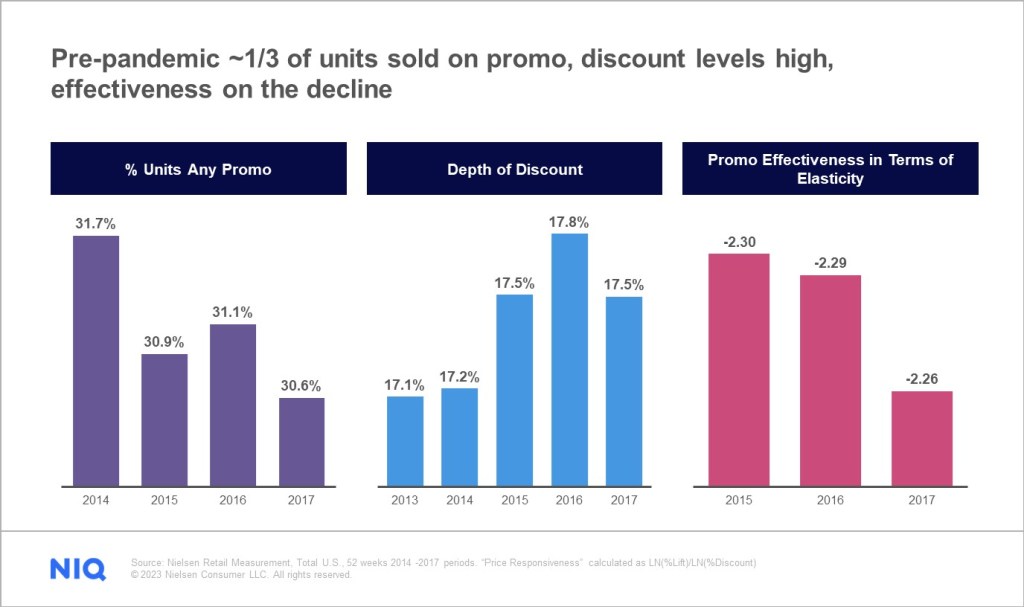

Prior to 2019, the percentage of units sold on promotion was upwards of 30%. Many categories trained shoppers to bridge from deal to deal, rarely capturing an off-promotion sale through the register. Taken one step further, a category that might have been purchased once a year and promoted too frequently or deeply was subsidizing volume unnecessarily, not driving growth, and had diminishing promotion effectiveness over time.

What if there was an off-ramp from all of this? A chance to revamp promotions that could provide value to the shopper and return the invested trade dollars to both the manufacturer and the retailer.

Did you know that it takes ~1.7 seconds for shoppers to select an item for purchase?

Retail footprints are shrinking from increased pressure on available merchandising space, and category variety is giving way to increased holding power for high-velocity SKUs.

Future-proof your business and download our helpful infographic.

The pandemic paved the way for consumer package goods companies to fundamentally redesign go-to-market promotions. Promotions powered down during the pandemic from demand increase and continued through the post-Covid supply chain challenges. The absence of promotional activity created a margin of opportunity that is closing rapidly. To efficiently and effectively maximize returns, companies must utilize a data-driven approach coupled with AI capabilities.

Understanding price elasticities to drive price points

Price elasticities (P.E.) conjure anxiety for consumers and manufacturers alike. The concept is relatively simple. It is a measure of how reactive a market is to a price change for a given product. A more inelastic coefficient means that for every 1% increase in price, there is a less than 1% decrease in volume demand. If there is a disproportionately higher decrease in volume resulting from a 1% price increase, then the product is more elastic.

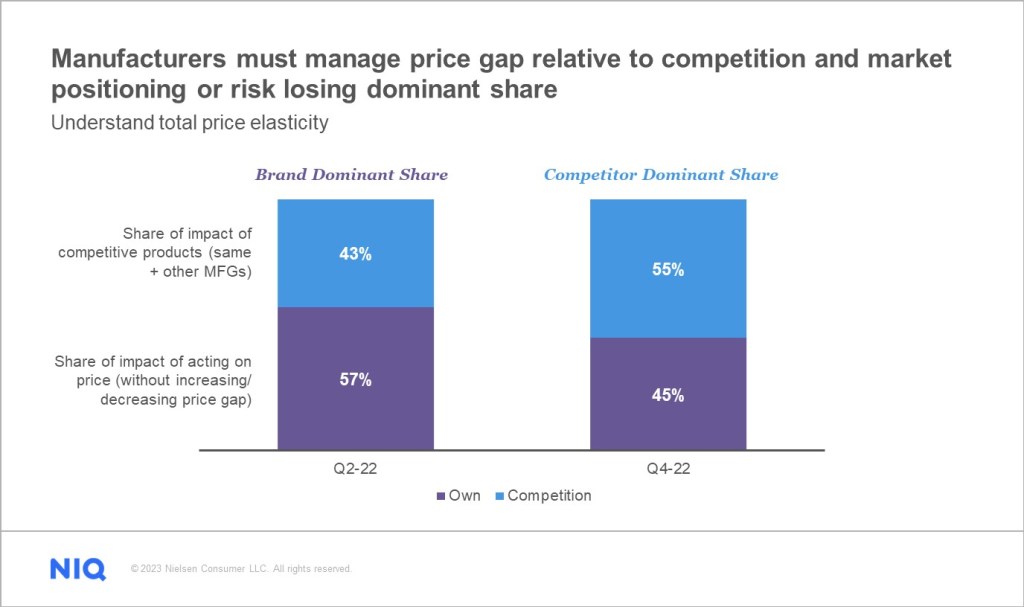

If it were only that simple: more variables influence price elasticity models. A critical piece to proper analysis is understanding the components of total price elasticity, like Own versus Competition. The actual number may be less important than the shared impact of acting on price (Own) versus the impact of competitive products (Competition).

In the example above, the impact of the price changes the brand is making in Q2 affects Total P.E. more than the effects of competitors’ price changes. Notice how the price relationship to the competitor changed in Q4 and became the dominant share. Based on the trend of the Competition share from Q2 to Q4, this scenario illustrates how managing the price gap relative to competition and price positioning in the market is more important.

Retail pressures

U.S. inflation hit a 40-year record in June 2022, and even a year later, policymakers across the globe are nervous about prices rising too fast. Brands need to begin promoting to keep consumers from leaking to private label alternatives.

Did you know shoppers are spending 36% more today than in 2019?

The aisle is up for grabs. Download our infographic to help future-proof your business.

Since 2019, average items carried in large categories like grocery and health and beauty have steadily declined. While top-of-the-funnel supply issues have abated for the most part, the focus needs to be on the last mile and how to consistently keep high-velocity items in stock.

Out-of-stock rates have been steadily increasing since January 2023 and are currently at 95% across the store; as a result, lost dollars are shrinking. The expectation is that as supply on shelf gets stronger, retailers and brands will return to full promotion plans that hopefully won’t be a race to the bottom like they were prior to the pandemic promo hiatus.

The path forward requires the courage to lead

The courage to lead requires a clear understanding of the market, your brand’s price elasticities, and brand equity with consumers. High brand equity and inelastic pricing is the best-case scenario, but that is rarely a brand’s circumstance.

The path to drive trade ROI requires a clear trade strategy and the tools to evaluate and course correct at the most granular levels in your organization. Evaluation tools that use AI are intuitive to use and allow promotions to be evaluated in near real-time and with efficiency.

Driving ongoing and consistent analysis provides useful insights to optimize trade executions throughout the year and provides data that can be used with retail partners in joint business planning. Knowing what’s working and what is not will keep your trade plans free from low-quality promotions.

Stay ahead of the competition

Learn about Revenue Optimizer and our other predictive analytics solutions.