Diabetic health and sugar

The two most important nutritional statistics diabetics are mindful of are carbohydrates and sugar. To maintain normal glucose levels, diabetics need to investigate product nutrition facts to be fully aware of how a food or beverage product will affect their glucose levels. Unfortunately, brands are failing when it comes to labeling their products with diabetic-friendly claims. According to our database, we find 79,000 plus food and beverage products that qualify for the “diabetic support” attribute—yet are not currently labeled as such.

What makes this process difficult is the great debate on what types of sweeteners are trending in the food space. Consumers’ preferences are constantly changing around artificial sweeteners and natural sweeteners. Depending on the type of sweetener being used, this can change the claims a brand can display on their packaging.

Aside from what’s being stated on the packaging, qualified claims are arguably more important as they allow brands to know everything their products qualify for so they can make sure they are tagging their products appropriately on e-commerce channels. If a beverage brand can’t fit “diabetic-friendly” on their packaging, but their product is qualifying for this attribute, they can still enter it into their PIM (product information management tool), so those products will populate when consumer’s search for them online.

What else is important besides diabetic health claims on the package?

NielsenIQ Label Insight is currently tracking over 2,300 products with a diabetic health claim stated on the package. If a product contains certain on-package copy like “low glycemic index” or “suitable for people with diabetes,” Label Insight’s machine learning and data transformation team will qualify this product with a stated on-package diabetic claim.

Although a product may contain on-pack sugar claims like “no added sugars,” “sugar-free,” or “contains artificial sweeteners,” diabetics still have to look further into the ingredients and nutrition facts panel. Using Label Insight’s Explore Market Navigator, we’re able to see that of the 2,300 plus products with a diabetic health claim on-package, 26 of those products also have a “no added sugars” claim, 404 have a “sugar -free” claim, 113 products have an “artificial sweeteners” claim, and 31 products have a “natural sweeteners” claim on-package.

One remarkably interesting stat in the NielsenIQ Label Insights database is that 162 products out of the 2300-plus with a diabetic health claim on package have over 10g of added sugar per serving. The American Heart Association recommends no more than 25g per serving a day for individuals with diabetes1.

What are diabetics buying?

Using NielsenIQ’s retail measurement data and the NPI (Nielsen Product Insight) characteristics, we also have the ability to see how well products with specific on-pack or off-pack claims are selling. In the latest 52 weeks, soft drinks are the leading category in products with a sugar-conscious claim on-package, at 6.6 billion dollars in sales.

Nutrition bars were the most sold food product (aside from sugar substitutes) with a diabetes support claim on pack, selling over $407 million in the past year. Cow’s milk is the number one selling category for diabetes support without a claim on-package.

Using NielsenIQ’s NPI characteristics, brands can better understand if their products can be labeled as diabetic-friendly and get in front of a consumer base who needs their products the most.

Diabetics and online searches in food and beverage

NielsenIQ Label Insight’s Trending Attributes tool tracks consumer searches across six different channels (Amazon, Target, Walmart, Kroger, Shipt, and Instacart), and allows brands to better understand the most searched attributes in specific food and beverage categories.

Over the past year, “Diabetic Support” searches are ranked 379 out of 700 attributes and are growing in search volume at 31%. From here, we can also see what categories “diabetic health” is being searched the most, with health and recovery drinks, cookies, and tea at the top of the chart.

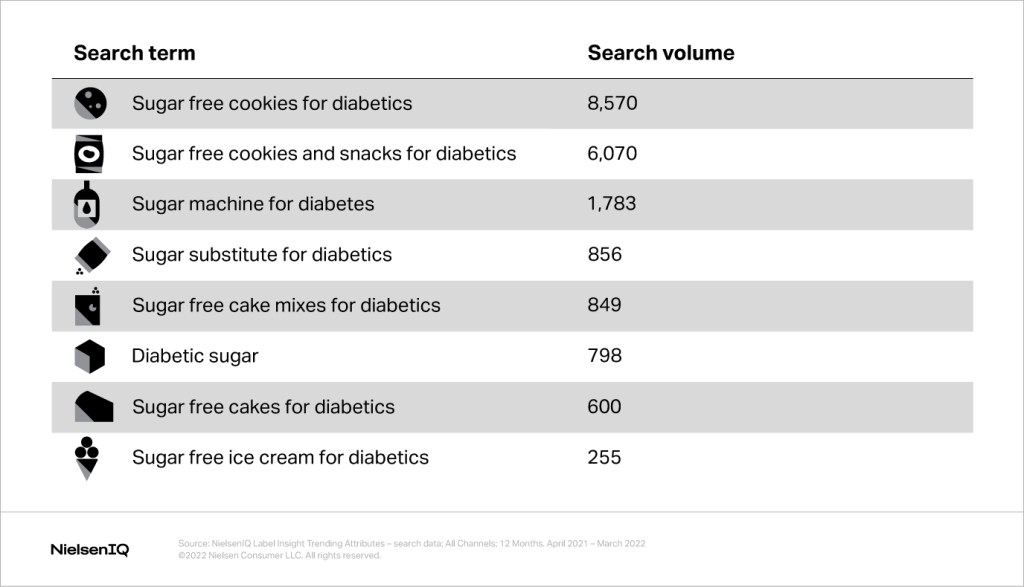

Label Insight’s Trending Attribute tool also allows you to see all the raw search data around diabetic health as well, and we can filter specifically for searches around sugar and diabetic health. Below are a few examples of what consumers are searching for:

Learn More

According to the CDC, 11.3% of the population in the U.S. have diabetes2 and that number is projected to grow based on current trends, especially after the pandemic. However, diabetics are not the only individuals concerned about their sugar intake these days. Diets like the Mediterranean diet, keto, and paleo all have a major focus on sugar and are gaining a lot of traction.

NielsenIQ offers the most granular insights into product attribution as well as ingredients, nutrition facts, search data, market measurement data, label claims and certifications and more so CPGs and manufacturers can stay informed and act on these high value opportunities.

Sources:

1 “How Too Much Added Sugar Affects Your Health Infographic.” www.heart.org, https://www.heart.org/en/healthy-living/healthy-eating/eat-smart/sugar/how-too-much-added-sugar-affects-your-health-infographic#:~:text=The%20AHA%20recommends%20limiting%20added,women%20and%20children%20over%202.