Online shopping events—a game changer

With e-commerce rising as a key retail channel generating strong revenue, manufacturers and brands are now encountering a new question of how to boost online sales and continue this growth momentum. Global online shopping festivals and events can be the next area to transform under the e-commerce evolution.

Underestimating them as a “one-time” event in the yearly sales calendar to generate “additional revenue” is a mistake. In fact, participating in these global online shopping festivals and events can be beneficial for brands in many ways, especially if they are looking for cross-border opportunities. Thanks to e-commerce and its technology, brands can easily set up their online space on global platforms without having to invest the same amount of money required when building physical stores —while avoiding any potential risks this strategy presents.

With the right data brands can test and track how their products perform by platform and market, which can help decide where to allocate resources and invest in advertising and promotions to improve overall ROI for their business.

Amazon Prime Day

To understand what a single event can do for brands, let’s take Amazon Prime Day as an example. During Amazon’s 48-hour Prime Day last year, total online sales in the United States were reported to surpass US$11 billion. Furthermore, retailers that brought in more than US$1 billion in revenue each year recorded a 29% increase in online sales during Prime Day compared with an average June day.

While Amazon Prime Day is only available for certain markets now, its impact will grow as this event is opened up to a wider range of categories, brands and markets owing to consumers’ growing interest.

According to our latest research conducted in Australia, Germany, Italy, Japan, Mexico, the United Kingdom, and the United States, 60% of Amazon members stated that they had shopped on Amazon Prime Day—of which 76% were already Amazon members and 20% purchased full-time memberships for this event.

Our digital shopping analysis on U.S. shoppers confirmed that Amazon Prime Day is creating opportunities for its competitors like Best Buy, Kohl’s, Target, and Walmart, as shoppers expect them to offer competing promotions and are motivated to visit their sites as well. This presents bigger selling opportunities for manufacturers and brands as Amazon and its competitors heat up for November’s Black Friday.

Black Friday and Cyber Monday

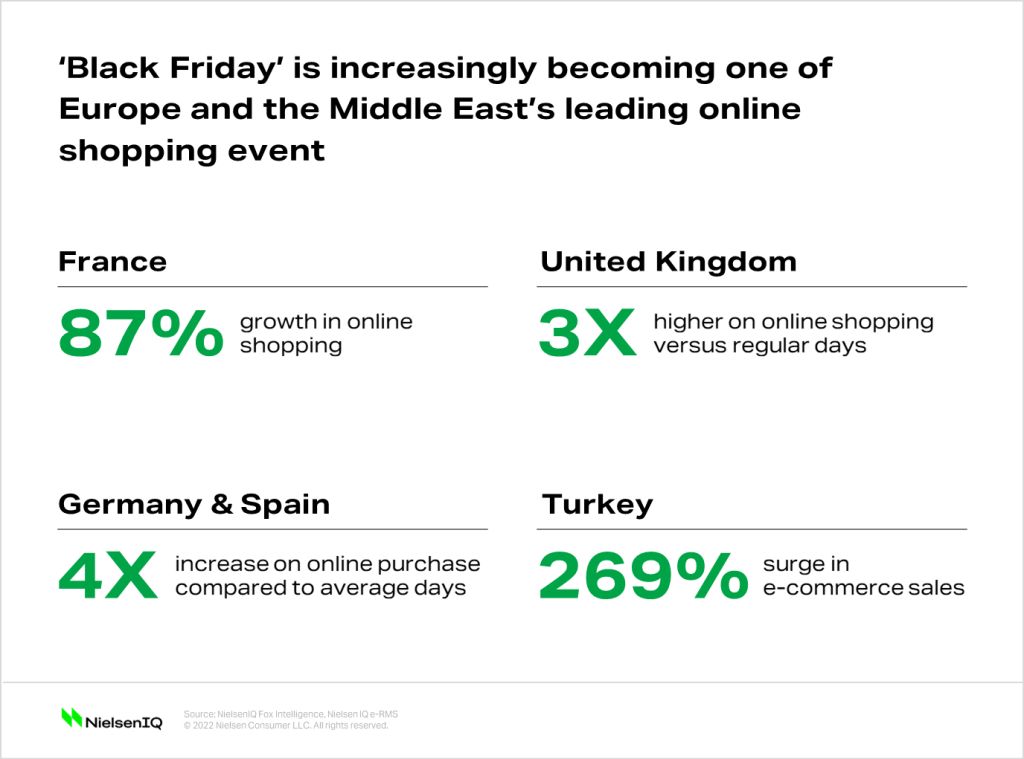

Black Friday, which began in the U.S., is now the world’s most highly anticipated shopping event. According to NielsenIQ Foxintelligence, European countries including France, Germany, Spain, and the United Kingdom all saw a peak in online sales during Black Friday.

France recorded 87% growth in online shopping in the week of Black Friday compared to the country’s weekly average in 2021. The impact was even bigger in Germany and Spain where online purchases during Black Friday were four times higher than an average day (versus three times higher in France and the United Kingdom) and the number of shoppers who purchased online during Black Friday week grew by 5% in 2021 versus 2020. In Turkey, e-commerce sales surged by 269% during Black Friday according to NielsenIQ e-RMS.

The impact of Black Friday is similar in Latin America. According to NielsenIQ Ebit, in Brazil the revenue generated from online sales grew by 5% during Black Friday in 2021 compared to the previous year. Especially in 2021, FMCG basket grew monthly with a distinctive 47% spike in online sales in November 2021 versus the previous month. This increase in online sales increased during the following Cyber Monday, as revenue rose by 16% with appliances growing by 43% and cell phones by 36% in 2021 versus 2020.

Double 11 and Double Days

Double 11 (or Singles Day) and Double Days (1/1, 2/2, etc.) are by far the two most successful online events in Asia. In fact, according to Alibaba and JD.com, these Chinese e-commerce giants reported mass sales of USD 139 billion during Double 11 in 2021. Although their impact remains within Asia, it has started to pick up in the Middle East and especially in Turkey where the online sales spiked by 255% during Double 11.

Moreover, considering Asia is the home of the world’s e-commerce trendsetter markets such as China and South Korea and accounts for 50% of the global e-commerce sales, brands looking for opportunities in Asia should pay attention to these events.

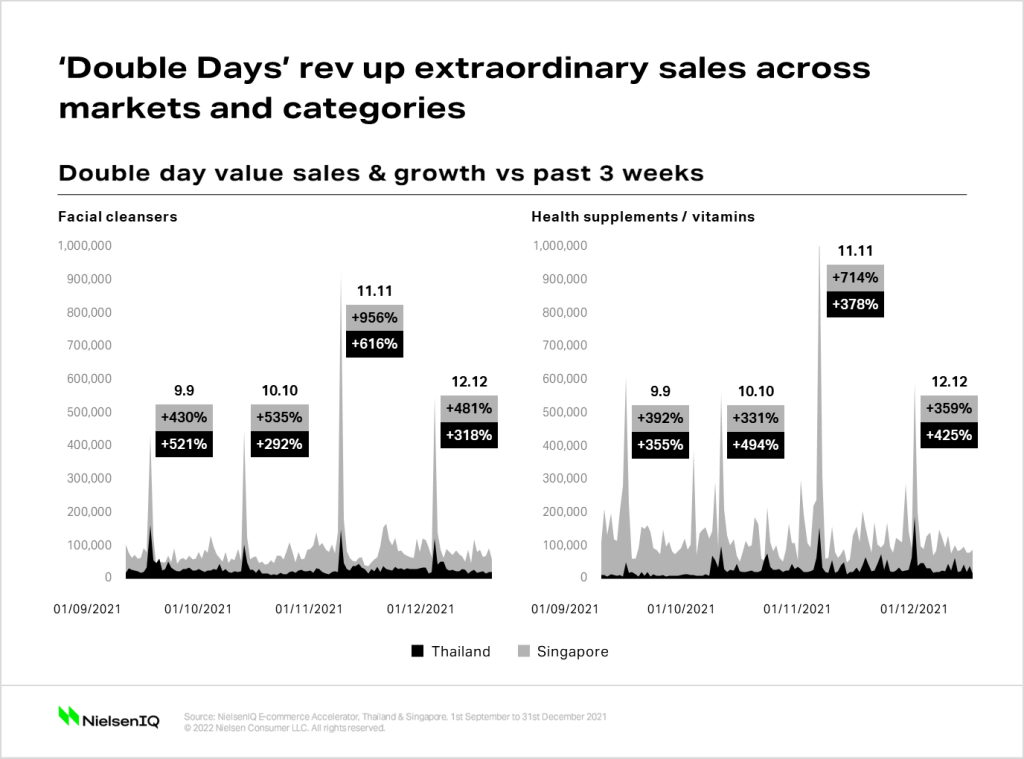

Triggered by the success of Double 11, Double Days are now creating a mass surge in sales across Asia. According to NielsenIQ E-commerce Accelerator, the sales of health supplements and vitamins rose by 714% on Double 11 and 359% on December 12 (or 12/12) last year in Singapore compared to the previous three weeks’ sales.

Meanwhile, we saw the sales of health supplements and vitamins surge by 328% on Double 11 and 425% on December 12 in Thailand, which may indicate that impact of Double 11 and Double Days in each market varies. Nevertheless, it is important to understand what difference these events can make on sales for FMCG manufacturers in Asia.

How can your brand capture and nurture new sources of growth?

E-commerce is now an ingrained shopping habit among consumers. Financial polarization and the continued escalation in prices of goods will further push consumers to seek ways to cut down their expenses. Today’s consumers know that it is online where they can find everyday low prices. Manufacturers must turn their eyes to new opportunities arising from these global e-commerce events, which can be nurtured into a new source of revenue and growth.

We strongly recommend brands take a strategic approach to these events by identifying products and categories that are in demand, running effective advertising campaigns and sales promotions and optimizing distribution channels that resonate with the right consumers, markets, platforms, and timing.

To do so, you need depth and granularity in data. NielsenIQ can help you understand e-commerce trends globally with key measurements such as daily sales, price and promotion monitoring, product placement in digital shelf and more that enables a holistic approach towards your online sales performance and ensure the success of your e-commerce strategy.